While the general public has been dishonestly assured, in many locales, that veteran homelessness has been “functionally ended”, we still continue to see and hear about homeless veterans who choose to remain on the street instead of opting for the “services” (shelters) and/or deal with indifferent nonprofits and the seemingly lackadaisical social worker class.

Despite the nonprofit model of high salaries and overhead with few documentable success stories to promote, the American taxpayer will be footing the bill for yet another year to help keep tax-exempt, nonprofit principals and employees comfortably housed and very well fed.

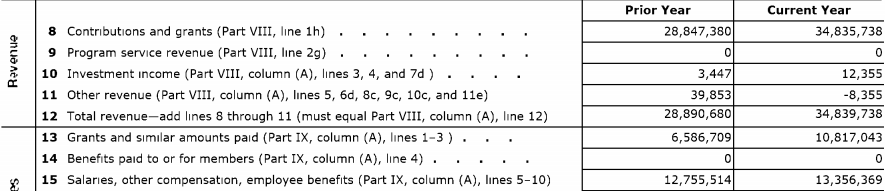

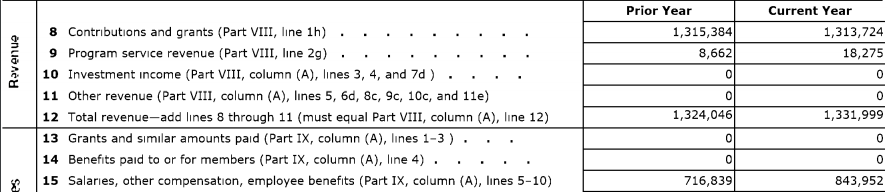

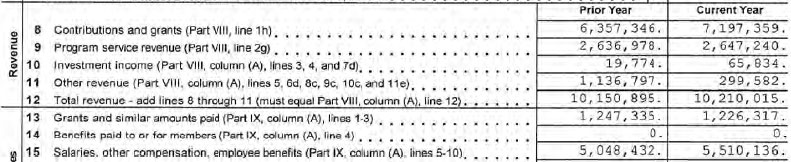

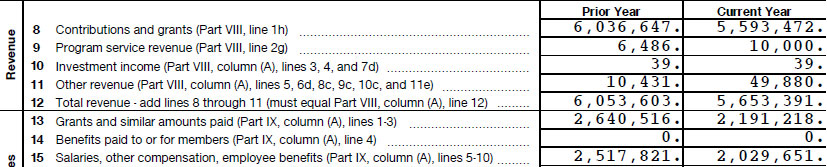

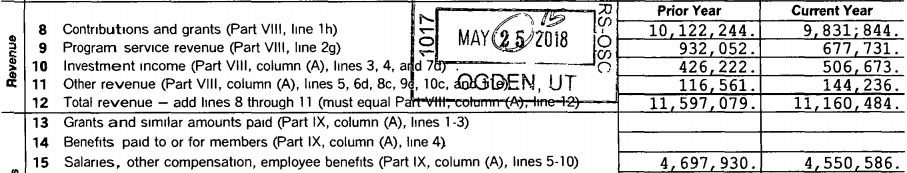

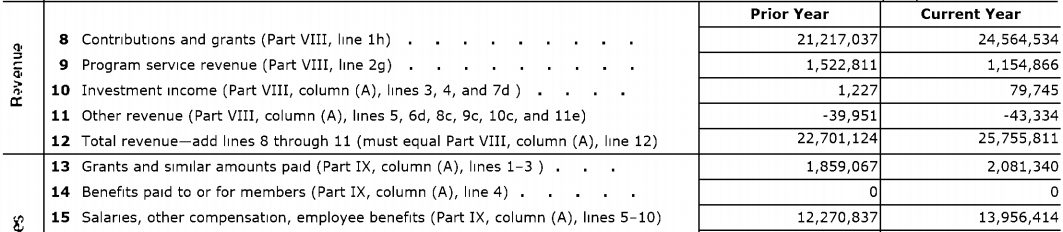

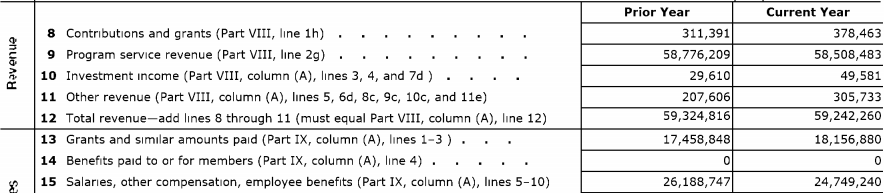

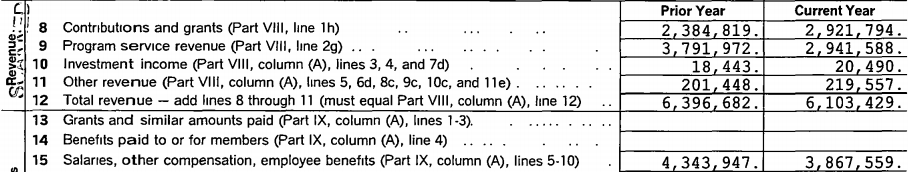

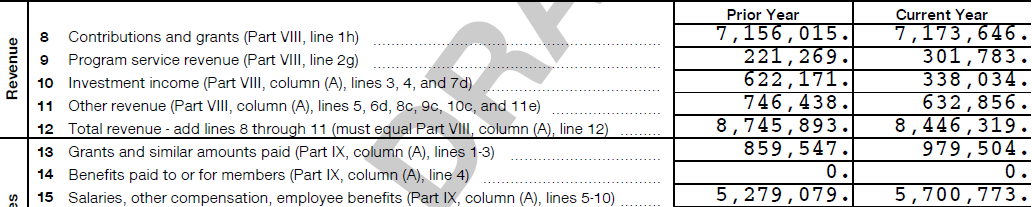

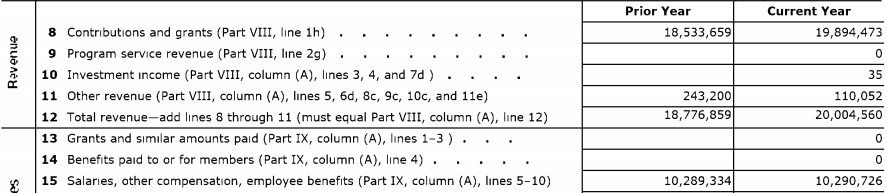

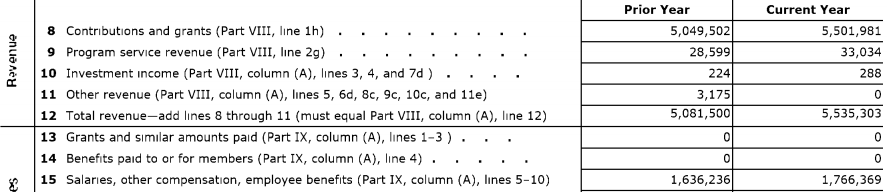

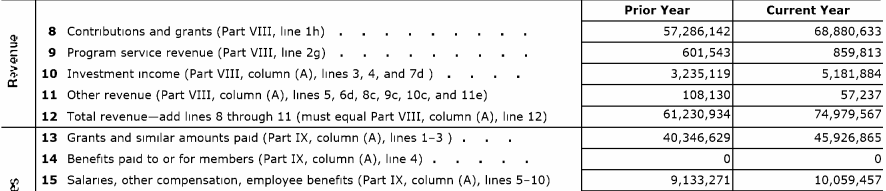

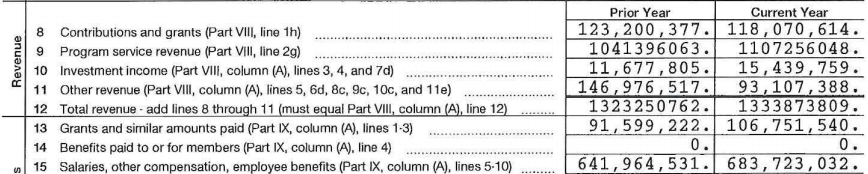

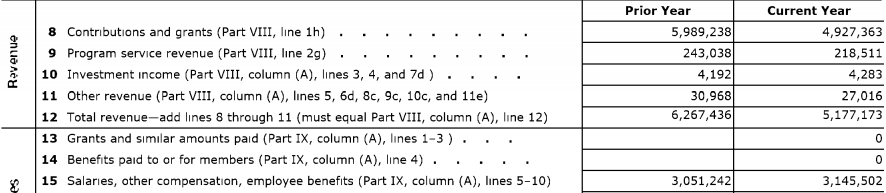

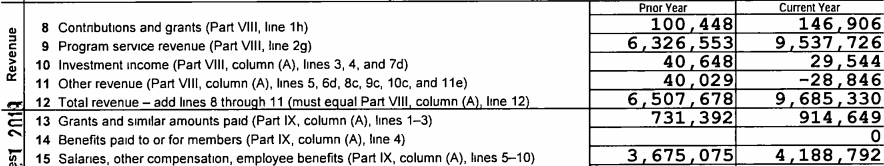

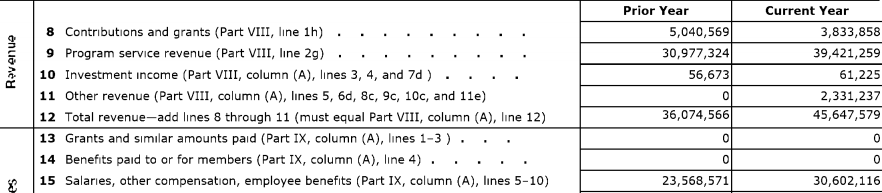

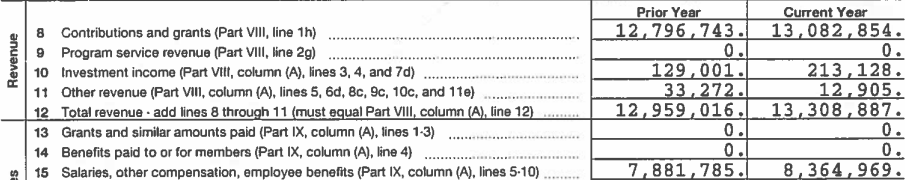

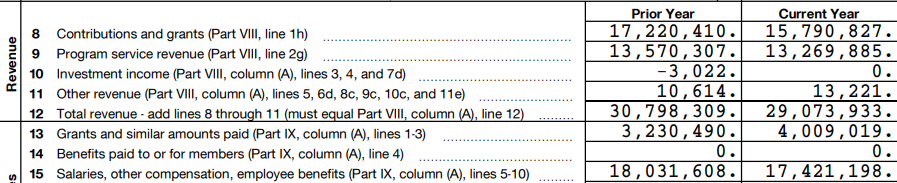

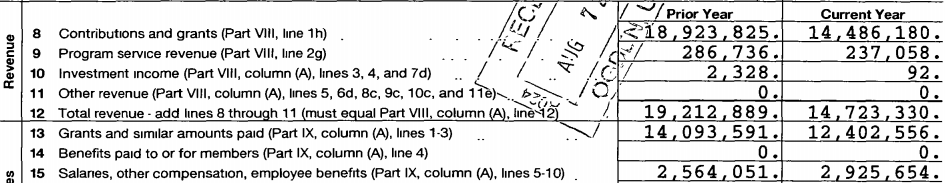

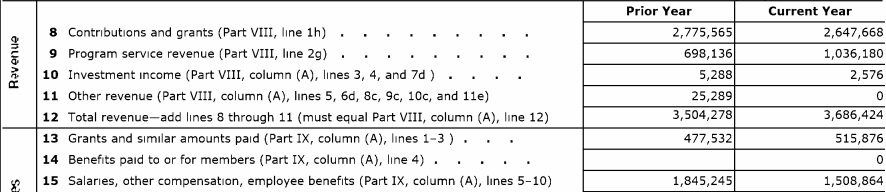

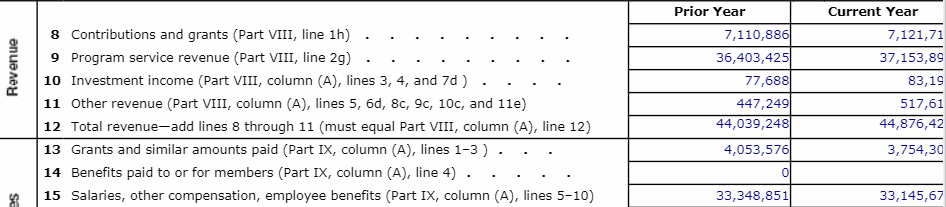

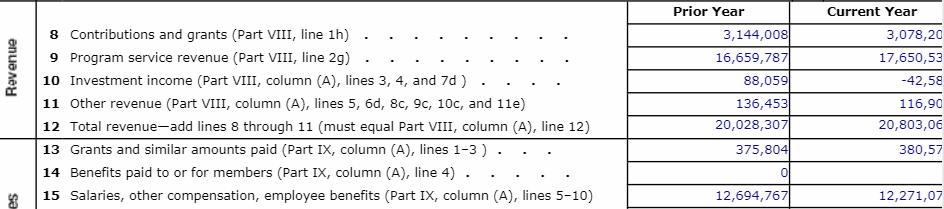

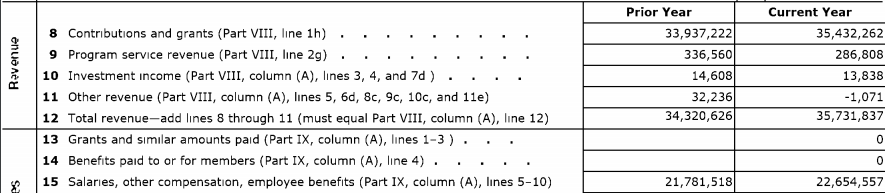

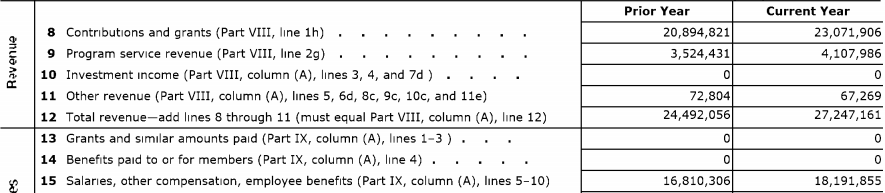

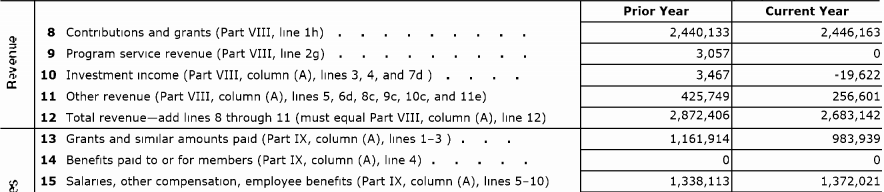

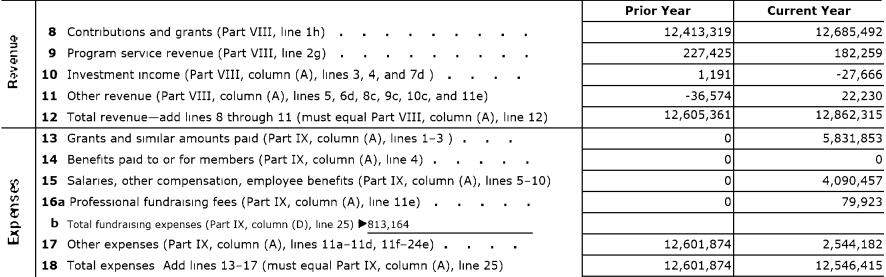

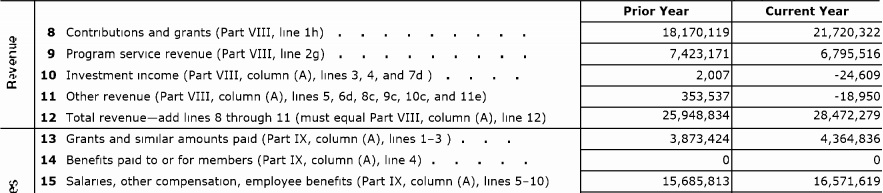

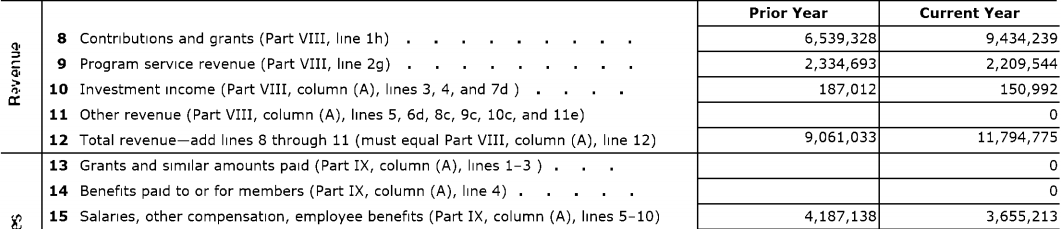

In particular, look at the amounts of “contribution and grants” coming into these nonprofits vice the “salaries, other compensation, employee benefits” supporting those who claim to care about veterans and you may not need an explanation as to why veterans are still in need of stable housing today.

In particular, look at the amounts of “contribution and grants” coming into these nonprofits vice the “salaries, other compensation, employee benefits” supporting those who claim to care about veterans and you may not need an explanation as to why veterans are still in need of stable housing today.

Note: Some of these nonprofits claim to have “ended” veteran homelessness but still maintain active web pages soliciting donations to help house homeless veterans….

ALASKA

Catholic Social Services: Anchorage CoC (Continuum of Care)

ALABAMA

Housing First, Inc.: Mobile City & County/Baldwin County CoC

ARIZONA

UMOM New Day Centers: Phoenix, Mesa/Maricopa County CoC

Primavera Foundation: Tucson/Pima County CoC

CALIFORNIA

Goodwill of Silicon Valley (dba Goodwill Industries of Santa Clara County): San Jose/Santa Clara City & County CoC

SHELTER, Inc.: Richmond/Contra Costa County CoC

The Salvation Army, a California Corporation: Los Angeles City & County CoC; Santa Maria/Santa Barbara County CoC; Oxnard, San Buenaventura/Ventura County CoC

The Salvation Army is listed as a “church”, they are not required to file a Form 990, so you’re just going to have to take their word for it.

Volunteers of America of Greater Sacramento and Northern Nevada, Inc.: Sacramento City & County CoC; Roseville, Rocklin/Placer, Nevada Counties; Davis, Woodland/Yolo County CoC; El Dorado County CoC

CONNECTICUT

Community Renewal Team, Inc.: Connecticut Balance of State CoC

FLORIDA

Advocate Program, Inc.: Miami-Dade County CoC; Monroe County CoC

Jewish Family & Children’s Service Of The Suncoast Inc: Sarasota, Bradenton/Manatee, Sarasota Counties CoC; Punta Gorda/Charlotte County CoC; Ft Myers, Cape Coral/Lee County CoC; Naples/Collier County CoC

GEORGIA

Central Savannah River Area Economic Opportunity Authority, Inc.: Georgia Balance of State CoC; Augusta-Richmond County CoC

IDAHO

El-Ada, Inc.: Boise/Ada County CoC

ILLINOIS

Thresholds: Chicago CoC; Cook County CoC

INDIANA

United Way of Central Indiana, Inc.: Indiana Balance of State CoC; Indianapolis CoC

LOUISIANA

Volunteers of America of Greater New Orleans: Lafayette/Acadiana Regional CoC; Lake Charles/Southwestern Louisiana CoC; Shreveport, Bossier/Northwest Louisiana CoC; New Orleans/Jefferson Parish CoC; Slidell/Southeast Louisiana CoC; Alexandria/Central Louisiana CoC; Houma-Terrebonne, Thibodaux CoC; Louisiana Balance of State CoC

Volunteers of America of Greater New Orleans has no Form 990 available online as…

Volunteers of America of Greater New Orleans has no Form 990 available online as…

Volunteers of America is exempt from filing Form 990 under Section 6033(a)(2)(A)(i), as an exempt organization described in Section 170(b)(1)(A)(i). However, in the interest of transparency, the organization completes a pro-forma Form 990.

— Volunteers of America, Our Financials

Get a load of these overall numbers.

Wellspring Alliance for Families, Inc.: Monroe/Northeast Louisiana CoC

MASSACHUSETTS

Volunteers of America of Massachusetts, Inc.: Boston CoC; Cambridge CoC; Quincy, Brockton, Weymouth, Plymouth City and County CoC; Massachusetts Balance of State CoC; Somerville CoC

MARYLAND

Alliance, Inc.: Cumberland/Allegany County CoC; Baltimore CoC; Harford County CoC; Annapolis/Anne Arundel County CoC; Howard County CoC; Baltimore County CoC; Carroll County CoC; Cecil County CoC; Frederick City & County CoC; Garrett County CoC; Mid-Shore Regional CoC; Hagerstown/Washington County CoC; Wicomico, Somerset, Worcester Counties CoC

“Alliance is a wholly-owned subsidiary of Mosaic Community Services”

MAINE

Preble Street: Maine Balance of State CoC

MICHIGAN

Wayne Metropolitan Community Action Agency: Dearborn, Dearborn Heights, Westland/Wayne County CoC; Washtenaw County CoC; Monroe City & County CoC

Southwest Counseling Solutions: Detroit CoC; Dearborn, Dearborn Heights, Westland/Wayne County CoC

NORTH CAROLINA

United Way of Forsyth County, Inc.: Winston-Salem/Forsyth County CoC

North Carolina Coalition to End Homelessness: Greensboro, High Point CoC

Passage Home, Inc.: Raleigh/Wake County CoC

NEW JERSEY

Catholic Charities Dioceses of Camden, Inc.: Atlantic City & County CoC; Camden City & County/Gloucester, Cape May, Cumberland Counties CoC; Salem County CoC

NEW MEXICO

Goodwill Industries of New Mexico: Albuquerque CoC; New Mexico Balance of State CoC

NEW YORK

HELP USA, Inc.: New York City CoC

H E L P Social Service Corporation has no formal mission statement or Form 990 available for public scrutiny….

Westchester Community Opportunity Program, Inc.: Poughkeepsie/Dutchess County CoC; Newburgh, Middletown/Orange County CoC; Yonkers, Mount Vernon/Westchester County CoC; Rockland County CoC; Sullivan County CoC; Kingston/Ulster County CoC

OHIO

FrontLine Service: Cleveland/Cuyahoga County CoC; Ohio Balance of State CoC

OKLAHOMA

Community Service Council of Greater Tulsa, Inc.: North Central Oklahoma CoC; Tulsa City & County CoC; Northeast Oklahoma CoC; Southeastern Oklahoma Regional CoC

TEXAS

Families in Crisis, Inc.: Texas Balance of State CoC

Caritas of Austin: Austin/Travis County CoC

These numbers were a little odd.

Catholic Charities Diocese of Fort Worth, Inc.: Fort Worth, Arlington/Tarrant County CoC

VIRGINIA

Virginia Supportive Housing: Richmond/Henrico, Chesterfield, Hanover Counties CoC; Charlottesville CoC; Virginia Balance of State CoC

And this is just a sampling of the proposed federal awards for fiscal year 2019 ($326 million) to nonprofits who receive donations, state and federal grants and do more to provide steady employment and incomes for their employees than the veterans they exploit.

And this is just a sampling of the proposed federal awards for fiscal year 2019 ($326 million) to nonprofits who receive donations, state and federal grants and do more to provide steady employment and incomes for their employees than the veterans they exploit.

Most retail businesses try and keep their employee costs between 15-30% to remain competitive, but as nonprofits don’t need to observe such fiscal disciplines, spending close-to or over half of their revenues on salaries and bennies, regardless of mission accomplishments explains why veteran homelessness is an issue they really don’t wish to ever be solved.

h/t Code of Vets

[…] is something we’ll continue to see on our street corners and sidewalks despite what politicians, bloated self-enriched nonprofits and the media say to our […]

[…] “veteran” on their title since. If the American people took the time to look at the IRS Form 990 of some of these veteran nonprofits, they’d see a startling […]